Get instant alerts every time your account is used.

Get instant alerts every time your account is used.

With a Tigers Community Credit Union Account, it’s easy to monitor your account activity, 24/7 with our free alerts. Login to Digital Banking today and customize your subscription alerts, and know immediately if your account is accessed fraudulently.

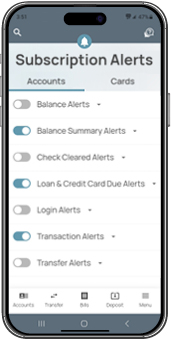

- Login Alerts

- Transaction Alerts

- Transfer Alerts

- Balance Alerts, and more!

If something doesn’t seem right, you can take action immediately and stop further fraudulent activity.

More Easy, Automated Free Tools to Help You Detect & Prevent Fraud.

You're busy. You need smart, automated tools to help you monitor your money. Check out more of the free services we offer to help you monitor your accounts.

MONITOR YOUR CREDIT SCORE

Unexpected changes to your credit score can be an early warning sign of identity theft. We think it's so important to know your credit score we put it right into our Mobile Banking App and in Online Banking for easy access.

USE DIGITAL WALLET

Encrypt your West Community Credit Cards and Debit Cards with the digital payment method of your choice. It's a simple, easy way to protect your payment info and keep your accounts safe under multiple layers of security.

SET REAL-TIME ALERTS

Keep tabs on your accounts with real-time email or text alerts. Login to digital banking to choose what you want to know. Schedule daily balance alerts, customize debit & credit card use alerts, set loan due alerts, and a lot more!

Make sure we have your correct contact information!

- Home Address

- Email Address

- Phone Number(s)

3 ways to verify your contact information

- Login to Digital Banking

- Call Member Services

(573) 443-8462 - Visit a branch near you

Steps to Prevent Fraud

You're an important part of keeping your accounts and identity protected from identity thieves and fraudsters. Here are some easy to follow tips:

- Shred ALL materials that have personal identifying info

- Avoid using public Wi-Fi

- Never share your PIN (Personal Identification Number)

- Never give out verification codes, and personal or account information when asked to do so on an unsolicited, incoming call, text or email.

- Use strong, unique passwords, change them regularly and keep them PRIVATE.

- Keep your anti-virus software up to date

- Be careful what you share on social media

- Only shop online with reputable businesses you trust. At a minimum only shop on secure sites.

- Online, in emails and texts, THINK BEFORE YOU CLICK!

As a general guideline, be highly suspicious anytime you are asked to provide personal information over the phone, or by text or email.

If you have given out your personal information on an unsolicited phone call or text message, please call Member Services at 573.443.8462.